The economy and markets in 2023 made sure all our natural emotions were functioning well: fear, despair, greed, jubilation, and finally relief.

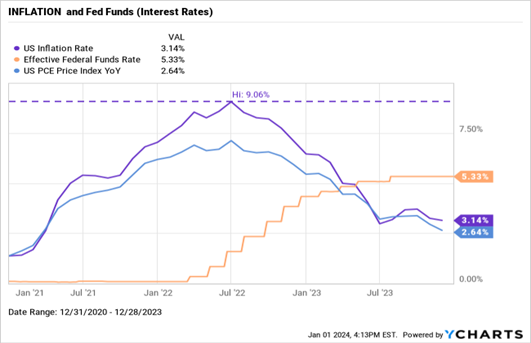

At the beginning of the year investors were expecting a no growth economy as measured by Gross Domestic Product “GDP” of 0.0% for 2023. At the beginning of the year, inflation was running hot, and the Federal Reserve was taking no prisoners by raising interest rates at a historic rate to break the back of inflation. The primary investor concern in 2023 was that the FED, in its mission to crack inflation, may push the US economy into recession. The annual change in the Consumer Price Index “CPI” was 6.6% at the beginning of the year and is now 3.1%. The FED’s tone throughout the year was “higher-for-longer”. However, by the end of 2023 clear signs were emerging that inflation was cooling off, especially in the labor market, prompting the bond market to “price-in” two to four ¼ point interest rate cuts in 2024.

In December 2023 the FED gave investors a welcomed year-end gift by communicating a significant pivot in monetary policy. At its December 13th meeting, the FED announced a change from “higher-for-longer” to forecasting that it may reduce interest rates by three – ¼ point reductions in 2024 and another four ¼ point cuts in 2025. It appears the FED may have accomplished the impossible: to squeeze out inflation in the economy by raising interest rates and navigating the economy to a no recession “soft landing”.

US Stock Markets – 2023

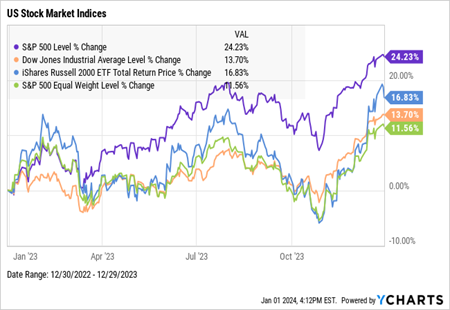

As the graph below illustrates, US Stock markets exhibited average volatility in 2023.

The big winners were large cap growth stocks which propelled the S&P 500 Index “S&P” 24% in 2023. In contrast the Dow Jones Industrial Average “DOW was up 14%. Why the 10-percentage point difference? Quite simply, the largest 10 stocks of the S&P represent 33% of the S&P; so – as go these 10 stocks so goes the S&P. Market participation expanded in the last two months of the year with small cap stocks rising 23% and financial stocks rising 18%, a signal the market is in a healthy position to advance in 2024.

2024 – DOW 43,000 in 2025 – why not!

Where are the US Economy and Capital Markets Headed?

Inflation is cooling, interest rates are expected to decline materially, and corporate earnings are expected to rise 10-12% in both 2024 and 2025. These factors give us optimism that the U.S. stock market may see another leg up in the next 18 months.

In a recent MarketWatch Opinion, the well-respected economist and strategist Ed Yardeni whom we follow closely made the following points-

Consumers have purchasing power.

“Many consumers may soon run out of their excess saving, as the economy’s naysayers are saying. Some consumers could be weighted down by too much consumer debt, especially student loans. Nevertheless most of them are likely to continue to consume as long as their job security remains high,…” We note there are 8.8 million jobs open in the US as of the end of November 2023, with 6.5 unemployed job seekers. Wages are once again rising at a rate modestly greater than inflation. These factors point to consumption rising, albeit, at a lower rate than in the past couple of years.

Onshoring boom is boosting capital spending.

“American and foreign manufacturing companies clearly are onshoring to the U.S. due to Supply-chain disruptions during the pandemic and growing geopolitical tensions between the U.S. and China.” New orders for construction machinery are up 30% during the past 2 years.

Housing is all set for recovery.

“The plunge in U.S mortgage interest rates since early November undoubtedly will boost new and existing home sales.” Existing and new home sales have plummeted 40% and 35%, respectively, since mortgage rates began rising in 2022. We are less optimistic than Ed Yardeni on this point although the US Housing market should recover moderately. The 30-year fixed mortgage rate is 6.6% down from the recent 7.4% high. We would not characterize this decline as “plummeting” as does Ed Yardeni. The current 6.6% rate compares to the 3.4% mortgage rate prior to the rapid rise in interest rates during the past two years. The Case-Shiller Home Price Index is up 32% during the past three years. In our opinion prices need to decline to spur housing demand.

Corporate cash flow is at a record high.

“The economy’s resilience can also be attributed to the awesome ability of U.S. corporations to generate cash flow. It totaled a record $3.4 trillion (on an annual basis) during the third quarter. That’s despite the pressure on companies’ profit margins coming from high labor costs and higher interest rates over the past couple of years. Corporate cash flow is up 4.4% year-over-year…” Corporate cash flow is the economic fuel to generate higher dividends and economic activity through capital expenditures.

Near-term risk facing the market: a U.S. Government shutdown.

Once again, the White House and Congress will be negotiating appropriation bills which come up on January 19th and others on February 2nd. I expect political theater as usual, but an agreement should be reached by the 12th hour. If by chance there is a government shutdown, I expect markets will sell off, but should recover when an agreement is consummated. This looming concern may be a catalyst for a market pullback and provide an excellent opportunity to add excess cash to the markets.

The future direction of the economy and capital markets is uncertain and as such the opinions in this commentary are not predictions or guarantees. We always recommend having sufficient cash, money markets or bonds (safe funds) to satisfy spending needs for three to four years.

Rich Lawrence, CFA January 4, 2023