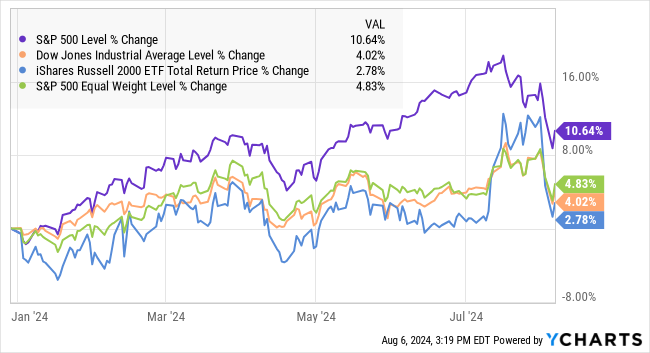

The market is now focusing on a broader range of economic factors rather than being singularly focused on just inflation and the FED – a healthy sign for markets in my opinion. As the chart above clearly shows, equity markets sold off after reaching their recent peaks on July 16, 2024. Technology stocks were the first to decline as investors became increasingly concerned about the trajectory of Artificial Intelligence “AI” capital spending and high valuation. Then on August 2nd the Department of Labor released its monthly job report showing signs the labor market is weakening faster than expected. The result: the Dow Jones Industrial Average “DOW” and the S&P 500 Index “S&P” sold off 4% and 5%, respectively. After the swift sell-off Thursday-Monday (08.05) with the DOW declining more than 2.200 points, the market stabilized on Tuesday 08.06 with the DOW rising 300 points.

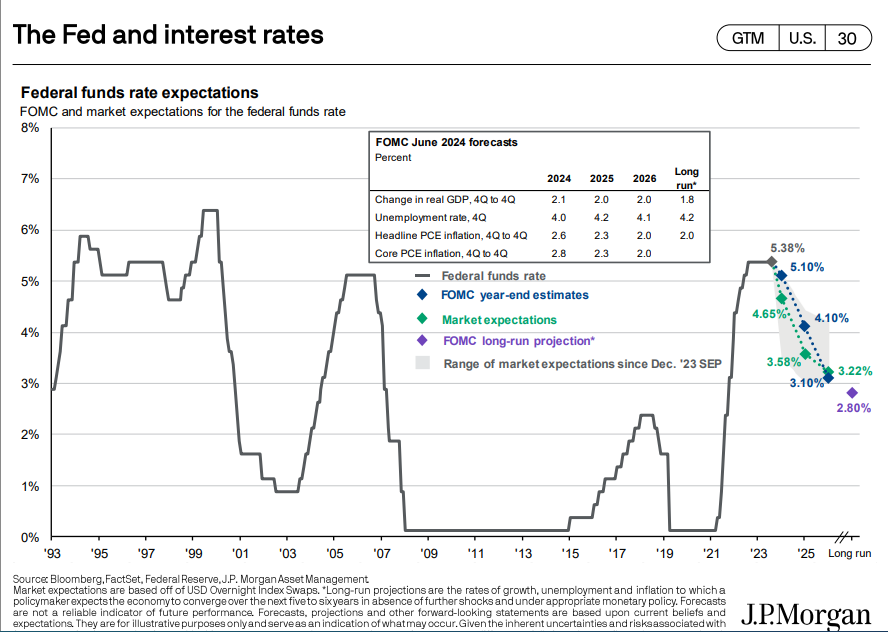

The market expects the FED to reduce interest rates in September 2024 with a 70% probability for a ½ point reduction and a 30% probability for a ¼ point reduction. I am in the ½ point camp. The FED sets the Fed Funds rate which is the interest rate banks charge each other for overnight lending. The Fed Funds rate is currently 5.25-5.50%, well above the Personal Consumption Expenditure Price Index “PCE” which is up 2.5% on a year-over-year basis. The FED needs to reduce the Fed Funds rate from the current level to the 3-4% range to shift monetary policy from being restrictive to neutral. The chart below shows the bond markets and the Federal Open Market Committee “FOMC” of the FED forecasts of the direction of the Fed Funds rate. As my British friends would say “let’s get on with it”.

The economy continues to expand, although there are clear signs the consumer is tightening its spending and economic growth is slowing. Retail sales growth has been declining over the past few months, while AAA Travel Services reported a record number of road warriors over July 4th . The housing market remains in a slump with existing sales of existing homes running at 3.9 million units (annualized) down from 4.4 million in March of 2024, and will likely remain muted until mortgage rates decline. A recession in 2024 does not look likely. Gross Domestic Products “GDP” estimates for 2024 are 1.8-2.5%, down from 2.0-2.5% earlier in the year.

2024 Outlook

Positive Tailwinds

- The economy continues to exhibit expansion with Gross Domestic Product “GDP’ expected to expand by 2.0% in 2024.

- Corporate earnings as measured by the S&P 500 Index are expected to grow 8-12% in 2024 and 2025.

- Interest rates are expected to decline.

- Inflation on the retreat.

Negative Headwinds

- Economic growth slows more than expected.

- Federal deficit spending continues to put upward pressure on prices by adding to “demand” in the economy.

- If inflation measures do not continue along their downward trajectory.

Rich Lawrence, CFA August 6, 2024

DISCLOSURE:

Opinions about the future are not predictions, guarantees or forecasts. Investing in stock and bond markets have risks that could lead to investors losing money.