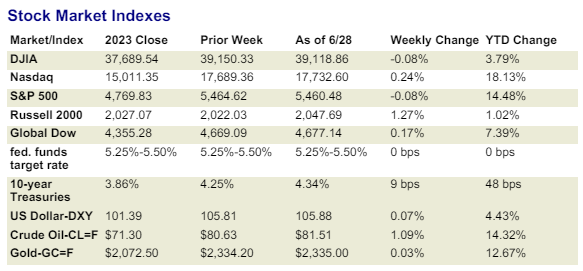

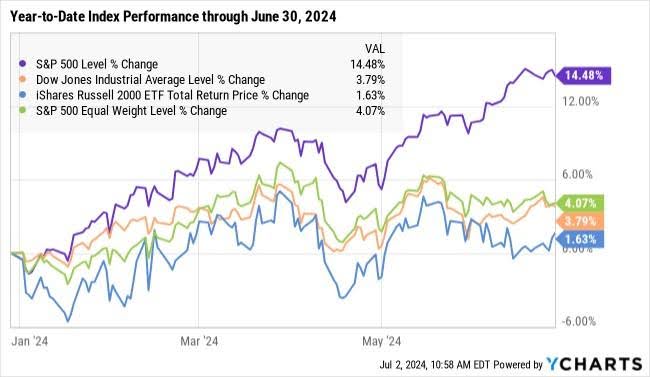

The above table and chart clearly show that technology and high growth stocks continue to drive market returns through June 2024. The largest 10 stocks in market capitalization represent 37% of the S&P 500 Index and generated most of the S&P 500 Index return so far in 2024. The graph above shows clearly the dispersion among the S&P 500 Index and the other three indices: the Dow Jones Industrial Average “DOW”, the “equally weighted” S&P 500 Index and the Russell 2000 Index (small cap stocks). We continue to structure your investment portfolio to include both “high growth” stocks as well as stocks of companies with lower valuations and steady earnings and dividend growth. Valuations appear high at the “Index” level with the price-to-earnings (P/E) ratio of the S&P 500 of 21.0x, well above the 16.7x 30-year average. However, when removing the top ten largest stocks from the calculation, the P/E ratio is 17.6x modestly greater than the 15.7x P/E ratio average for the past 30 years.

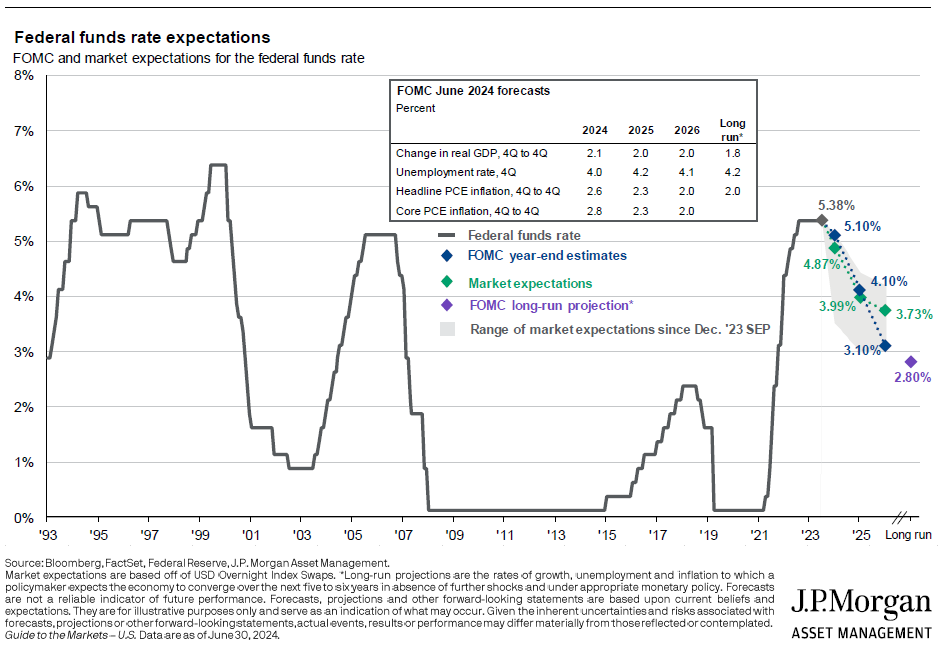

The higher-than-average valuations are justified, in my opinion, due to strong 8-12% annual earnings growth in 2024 and 2025 and the expected decline of interest rates. Markets are myopically focused on inflation which will dictate Federal Reserve “FED” Monetary Policy. The chart below illustrates FED interest rate guidance and how the bond market is “pricing-in” expected interest rate cuts. The Federal Open Market Committee “FOMC” recently updated its economic forecast for 2024-2026. The FOMC forecasts that it will reduce interest rates by 1- 1⁄4 point cut in 2024; 3- 1⁄4 point cuts in 2025; and 5 1⁄4 point cuts in 2026. These cuts will reduce the Federal Funds Rate from the current 5.25-5.50% target range to 3.00- 3.25% in 2026.

The US inflation rate is now 3.3% as measured by the Consumer Price Index, down from its 9.1% 2023 peak. The FED’s goal for inflation remains at 2.0%. The CPI is ‘sticky” in the mid-3% level. As a result, interest rate cut expectations declined dramatically since the beginning of the year when the market was expecting 6 – 1⁄4 point cuts in 2024 to the current 1 to 2 – 1⁄4 point cuts in 2024. The European Central Bank “ECB” reduced interest rates in June and the UK may follow by the end of the summer. The bias is clearly on the downside when it comes to the direction of interest rates as set by the major central banks, except for Japan. The FED is on hold right now, but we expect the Fed will reduce rates this year by 1 – 1⁄4 point.

2024 Outlook

Positive Tailwinds

- The economy continues to exhibit expansion with Gross Domestic Product “GDP’ expected to expand by 2.0% in

2024. - Corporate earnings as measured by the S&P 500 Index are expected to grow 8-12% in 2024 and 2025.

- A strong labor market: consumer spending is tied closely to employment.

- Inflation on the retreat

Negative Headwinds

- Inflation does not decline as expected, prompting the FED to pause reducing interest rates at the pace it previously stated.

- Federal deficit spending continues to put upward pressure on prices by adding to “demand” in the economy.

- If inflation measures do not decline as expected, the market may decline or “correct” in anticipation of the FED pushing out reducing interest rates to 2025.

DISCLOSURE:

Opinions about the future are not predictions, guarantees or forecasts. Investing in stock and bond markets have risks that could lead to investors losing money.